internet tax freedom act wisconsin

Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing transaction taxes on internet access one of the exceptions being that states already taxing internet access as of October 1 1998 were grandfathered in. The legislation established an end date of June 30.

The internet tax freedom act originally enacted in october 1998 does not prohibit wisconsin from taxing sales over the internet.

. Accordingly the six remaining states that tax Internet access Hawaii New Mexico Ohio South Dakota Texas and Wisconsin must by federal law stop. The Internet was still the start-up and the premise was that people wanted a way to access the Internet. The ten states are Hawaii New Hampshire New Mexico North Dakota Ohio South Dakota Tennessee Texas Washington Wisconsin.

Texas collected tax on internet access prior to the. Since no one knew it the initial act was a 10-year ban on the taxation of Internet usage instead of a lifelong exemption. The exemption is mandated by the Internet Tax Freedom Act ITFA which was first enacted in 1998 to encourage growth of the fledgling internet.

Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. Freedom Act Amendments Act of 2007 extended the prohibition of tax on Internet access services through November 1 2014 this Act also extended the grandfather clause under which Wisconsins tax on Internet access is protected through November 1 2014. Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin.

Multiple or discriminatory taxes on electronic commerce. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire. Our previous news item Congress Approves Permanent Extension of Internet Tax Freedom Act details how an end date of June 30 2020 was established for seven states including Wisconsin that imposed a tax on internet access.

Remote sellers are required to collect and remit tax on all taxable sales into Wisconsin including sales made online. Permanent Internet Tax Freedom Act HR. The Internet Tax Freedom Act The Internet Tax Freedom Act of 1998 places a moratorium on new taxes pertaining to.

The Internet Tax Freedom Act ITFA. The is in contrast. But foreseeing how taxing internet access and other digital activities could stall the growth of the Internet Congress passed the Internet Tax Freedom Act.

113th Congress The Permanent Internet Tax Freedom Act is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or discriminatory taxes on electronic commerce. The law bars federal state and local governments from taxing Internet access and from imposing discriminatory Internet-only taxes su. Effective July 1 2020 charges for internet access services are no longer subject to Wisconsin sales and use tax.

For the years 1909 through 1912 the taxpayer filed tax returns under the 1909 Act. The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL. The Corporation Excise Tax Act of 1909 was enacted on August 5 1909 and was effective retroactively to January 1 1909.

At the time no one knew what. The states would have collected nearly 1 billion in fiscal year 2021. Hawaii New Mexico North Dakota Ohio South Dakota Texas and Wisconsin.

But remember the ITFA only prevents states from taxing things like internet access such as a cable or DSL subscription and not items purchased via the internet such as a set of new patio furniture you. Promoting Better Broadband Fighting Data Caps and Usage-Based Billing. 105277 text PDF on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet.

Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month. On july 1 sales taxes levied on internet access in six stateshawaii new mexico ohio south dakota texas and wisconsinwill become illegal under the provisions of the permanent internet tax freedom act pitfa. Law360 June 14 2021 332 PM EDT -- Wisconsins tax department released a series of updated rules Monday to reflect that the state can no longer impose sales or use tax on internet access.

Back in 98 when the Internet was just gaining steam Congress passed the Internet Tax Freedom Act prohibiting state and local governments from adding taxes to Internet bills. The Internet Tax Freedom Act prohibits Wisconsin from imposing a sales tax on Internet access services but does not prohibit. 105-277 enacted in 1998 implemented a three-year moratorium preventing state and local governments from taxing Internet access or imposing multiple or discriminatory taxes on electronic commerce.

For sales on or after June 30 2008 Wisconsin sales and use taxes do not apply to the sale of. Congress extended the ITFA. This change correlates with legislation enacted in 2016 that permanently extended the Internet Tax Freedom Act.

On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent Internet Tax Freedom Act PITFA. Internet Access Service Charges Exempt in Wisconsin Beginning July 1 2020. Internet tax freedom act wisconsin.

Internet Tax Freedom Act - Title I. The Wisconsin Department of Revenue informs taxpayers that Wisconsin is currently exempt from the Internet Tax Freedom Act and therefore imposes sales tax on Internet access services. The Act was signed in 1998 on Internet Tax Freedom.

PITFA represents a permanent ban on taxing internet access and an elimination of the grandfathered ability to tax internet access currently allowed in seven states. As of July 1 2020 those fees will be exempt. The Internet Tax Freedom Act ITFA.

The Internet Internet access online services or. These states are under the grandfathered clause allowed to tax internet access because they implemented a tax prior to. 1 taxes on Internet access.

At the time people mostly used it for email. As part of Wisconsins enacted budget bill Wisconsins sales tax on internet access charges is repealed effective July 1 2020. Moratorium preventing state and local governments from taxing Internet access or imposing.

105-277 enacted in 1998 implemented a three-year.

What Is The Internet Tax Freedom Act Howstuffworks

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

How To Register For A Sales Tax Permit In Wisconsin Taxvalet

What Is The Internet Tax Freedom Act Howstuffworks

Controversial Internet Tax Freedom Act Becomes Permanent July 1

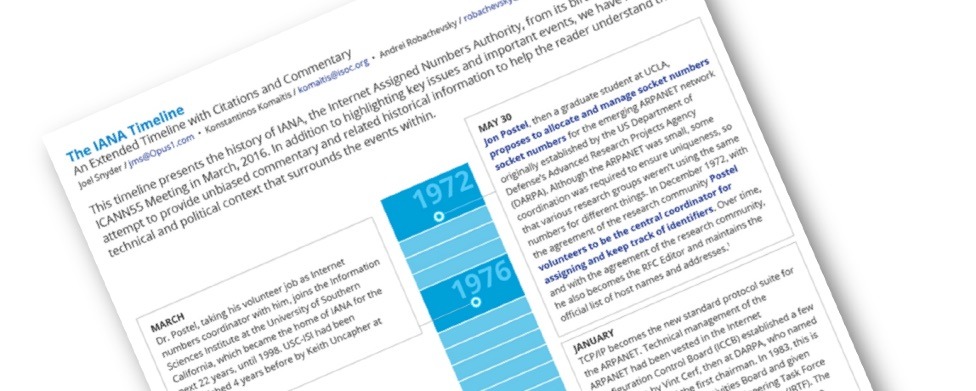

The History Of Iana Internet Society

Notary Signing Agent Document Faq Usa Patriot Act Cip Forms Nna

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute